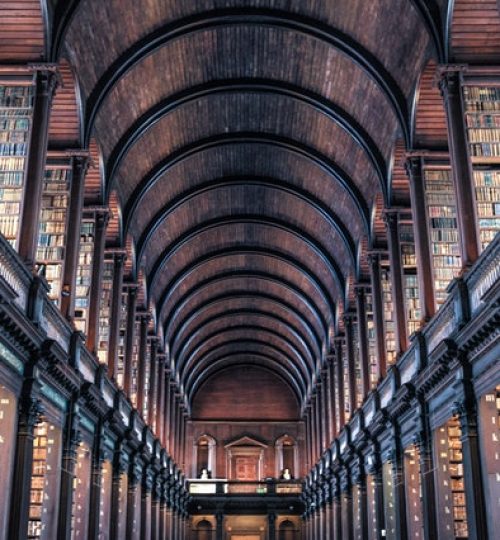

Resources

Overview

A variety of methods have been proposed to trade markets. Broadly speaking, we can divide them into three categories:

- Fundamental analysis: it aims to measure the intrinsic value of a security by examining economic data so investors can compare the security’s current price with estimates to see if the security is undervalued or overvalued. However, a common criticism of fundamental analysis is that the timing of enter and exit of trades is not specified. Even the markets move towards the estimated price, a bad timing of entering the trades could lead to huge drawdowns and such moves in account values are often not bearable to investors, shaking them out of the markets.

- Technical analysis: it is in contrast to fundamental analysis where a security’s historical price data is used to study price patterns. Technicians place trades based on a combination of indicators such as the Relative Strength Index (RSI) and Bollinger Bands. However, due to the lack of analysis on economic or market conditions, the predictability of these signals is not strong, often leading to false breakouts.

- Algorithmic trading: it is a more systematic approach that involves mathematical modelling and automated execution. Examples include trend-following, mean-reversion, statistical arbitrage and delta-neutral trading strategies. These strategies often rely on models that produce a good predictive signal. However, due to low signal-to-noise ratio of financial data and the dynamic nature of markets, these signals are difficult to construct.

Fundamental Analysis

- Graham, Benjamin. “The Intelligent Investor.” Prabhat Prakashan, 1965.

- Graham, Benjamin, Sidney Cottle, Charles Tatham, and David L. Dodd. “Security analysis: Principles and technique.” (1962).

- Graham, Benjamin, and Spencer Barrett Meredith. “The interpretation of financial statements.” Vol. 4. New York: Harper, 1937.

- Warner, Stuart, and Si Hussain. “The Finance Book: Understand the numbers even if you’re not a finance professional.” Pearson UK, 2017.

Technical Analysis

- Tharp, Van K., Christian Chabot, and K. Tharp. “Trade your way to financial freedom.” McGraw-Hill, 2007.

- Lefevre, Edwin. “Reminiscences of a Stock Operator (Wiley Investment Classics).” Wiley, 2012.

- Schwager, Jack D. “A complete guide to the futures markets: Fundamental analysis, technical analysis, trading, spreads, and options.” John Wiley & Sons, 1984.

- Schwager, Jack D. “Market wizards, updated: Interviews with top traders.” John Wiley & Sons, 2012.

Algorithmic Trading

- Chan, Ernie. “Quantitative trading: How to build your own algorithmic trading business.” Vol. 430. John Wiley & Sons, 2009.

- Chan, Ernie. “Algorithmic trading: Winning strategies and their rationale.” Vol. 625. John Wiley & Sons, 2013.

- Chan, Ernest P. “Machine trading: Deploying computer algorithms to conquer the markets.” John Wiley & Sons, 2017.

- Le Beau, Charles, and D. Lucas. “Technical traders guide to computer analysis of the futures markets.” Irwin Professional (USA) (1992).

- Quantopian has very nice lectures on algorithmic trading: https://www.quantopian.com/lectures