“Cut losses short and let profits run.”

– Jesse Lauriston Livermore

Publications

Deep Reinforcement Learning for Trading

We adopt Deep Reinforcement Learning algorithms to design trading strategies for continuous futures contracts. Both discrete and continuous action spaces are considered and volatility scaling is incorporated to create reward functions which scale trade positions based on market volatility.

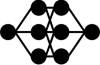

DeepLOB: Deep Convolutional Neural Networks for Limit Order Books

We develop a large-scale deep learning model to predict price movements from limit order book (LOB) data of cash equities. The architecture utilises convolutional filters to capture the spatial structure of the limit order books as well as LSTM modules to capture longer time dependencies.

How does stock market work?

The stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place.

Resources

Financial trading has been a widely researched topic and a variety of methods have been proposed to trade markets over the fast decades. Broadly speaking, these include fundamental analysis, technical analysis and algorithmic trading. In this section, I would love to share some of resources that I find useful to understand each of these methods.